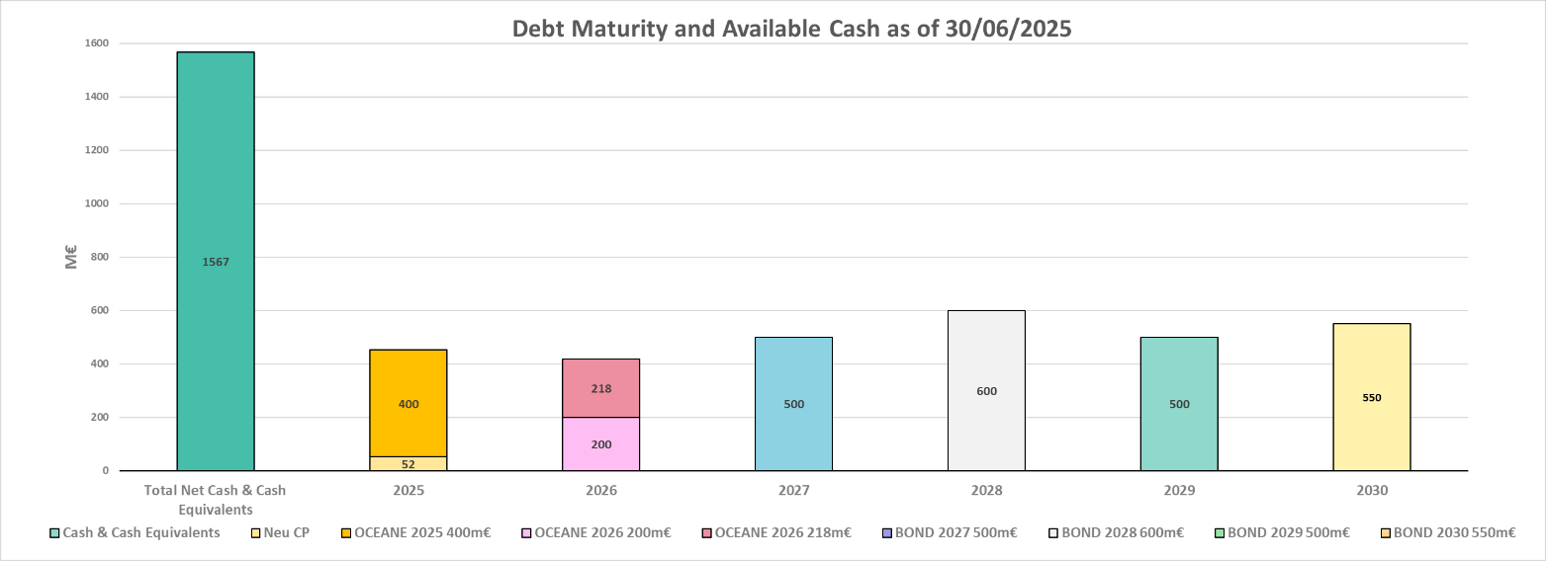

Note: Bonds figures based on their face value.

Debt & Rating

Debt profile

As of June 30th 2025 Worldline Group net debt totaled € 2,125 Million.

On the scope of the continued operations, this amount was made up of:

- Cash and cash equivalents net of overdraft amounting to € 1,567 million.

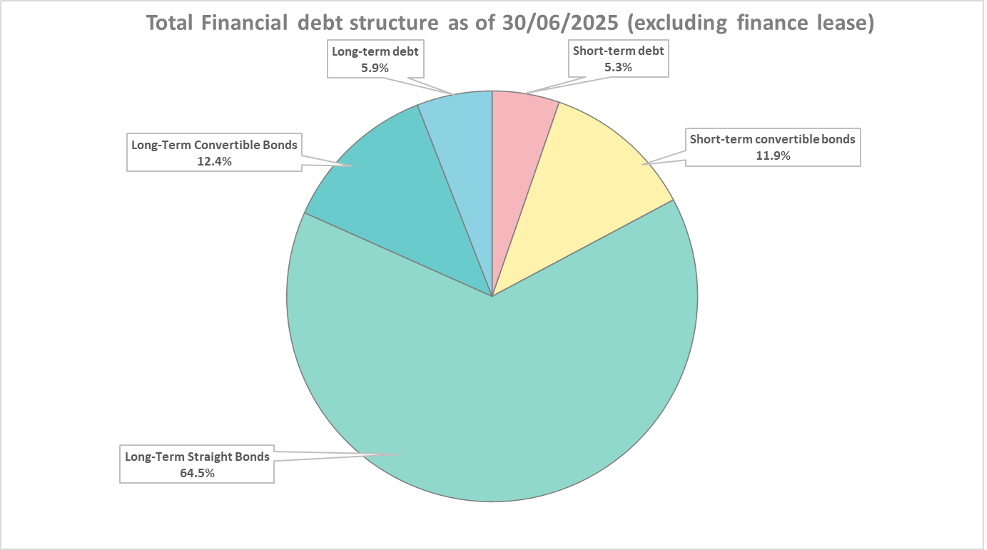

- Gross debt recognized in the Group consolidated balance sheet net of overdraft up to € 3,692 million. Outstanding amount of current borrowings totaled € 570 million, non-current borrowings totaled € 2,741 million, and financial leases totaled € 381 million.

Average maturity: 2.76 years

(average maturity is the weighted average of residual maturities of bonds and commercial paper)

Average cost of debt: 2.88%

(average cost of debt is the weighted average of coupon rates of bonds and commercial paper)

Rating

| Date | Long-term (S&P) | Outlook | Short-term (S&P) | Related documents |

|---|---|---|---|---|

| 13/11/2025 | BB | Negative | B | Credit opinion › |

| 22/08/2025 | BB | Negative | B | Credit opinion › |

| 02/07/2025 | BBB- | Negative | A-3 | S&P Worldline FAQ › |

| 27/03/2025 | BBB- | Negative | A-3 | Credit opinion › |

| 24/09/2024 | BBB- | Negative | A-3 | Credit opinion › |

| 08/11/2023 | BBB- | Stable | A-3 | Credit opinion › |

| 17/11/2022 | BBB | Stable | A-2 | Credit opinion › |

| 19/11/2021 | BBB | Stable | A-2 | Credit opinion › |

| 31/07/2020 | BBB | Stable | A-2 | Credit opinion › |

| 04/09/2019 | BBB | Stable | A-2 | Credit opinion › |

Commercial Papers

Worldline has entered into a Negotiable European Commercial Paper program (NEU CP) on April 12th 2019 for a maximum initial amount of € 600 million. The size of the NEU CP program has been raised to € 1,000 million in November 2020.

On June 30th 2025, the outstanding amount of the program was € 52 million.

Revolving Credit facility

In addition, Worldline has an undrawn revolving credit facility (RCF) available for a total amount of € 1,125 million maturing in July 2030.

Bonds

Worldline Group has issued debt securities including bonds (straight bonds or bonds issued under an EMTN program), as well as convertible bonds.

-

In June 2020, Worldline entered into a Euro-Medium-Term Note (EMTN) Program for a maximum amount of € 4,000 million.

Document Date EMTN Base Prospectus 30/05/2025 Second Prospectus Supplement 19/05/2025 First Prospectus Supplement 07/11/2024 EMTN Base Prospectus 21/06/ 2024 First Prospectus Supplement

29/08/2023 EMTN Base Prospectus 30/05/2023 EMTN Base Prospectus 22/06/2020

Two bond issuances (of which € 500 million expired on 30/06/2023 and € 500 million expiring on 30/06/2027) were completed under the EMTN program on June 22, 2020. A bond issue was carried out on September 5, 2023 as part of the EMTN program (issue of € 600 million maturing on September 12, 2028). A bond issue was carried out on 21 November 2024 as part of the EMTN program (issue of € 500 million maturing on November 27, 2029). A bond issue was carried out on 3 June 2025 as part of the EMTN program (issue of € 550 million maturing on June 10, 2030).

Instrument ISIN Date of issuance Amount Rate Tenor Maturity Related documents Obligation FR0014010A08 10/06/2025 550 m€ 5.500% 5y 10/06/2030 Final Terms

Press release

Rating S&PObligation FR001400U2E7 27/11/2024 500 m€ 5.250% 5y 27/11/2029 Final Terms

Press release successful placement

Rating S&PObligation FR001400KLT5 12/09/2023 600 m€ 4.125% 5y 12/09/2028 Final terms

Press releaseObligation FR0013521564 30/06/2020 500 m€ 0.875% 7y 30/06/2027 Final terms

Press release -

Worldline issued interest-free bonds convertible into new shares and/or exchangeable for existing shares.

The first € 600 million issuance maturing in July 2026 took place on July, 30 2019; it was retaped by a € 200 million issuance in December 2020. In November 2024, a partial reimbursement was done of approximately € 50 million. Additionally, in June 2025, a partial reimbursement was done of approximately €332 million.

A second € 600 million issuance occurred on July, 30 2020. It will mature in July 2025. In November 2024, a partial reimbursement was done of approximately € 200 million and the remaining amount was repaid at maturity date in July 2025.

Instrument ISIN Date of issuance Amount Rate Tenor Maturity Related documents Oceane FR0013439304 30/07/2019 600 m€ 0.00% 7y 30/07/2026 Terms and conditions

Press releaseOceane FR0013526803 30/07/2020 600 m€ 0.00% 5y 30/07/2025 Terms and conditions

Press releaseOceane FR0013439304 04/12/2020 200 m€ 0.00% 6y 30/07/2026 Terms and conditions

Press release

Other relevant documents